Marketing budgets are rising back after plummeting to a historic low last year, reveals Gartner in its State of Marketing Budget and Strategy 2022 report [download page]. This year CMOs estimate dedicating 9.5% of their revenues to their total marketing expense budget, up from last year’s 6.4% but still trailing the pre-COVID levels that ranged from 10.5-11.2% between 2018 and 2020.

The results indicate that Financial Services firms are allocating the largest share of their revenues (10.4%) to marketing budgets, while Tech Product companies reported the biggest jump from last year (5% in 2021 to 10.1% this year). However, there appears to be stagnation in budgets for Consumer Goods firms, at 8% of company revenues this year versus 8.3% last year.

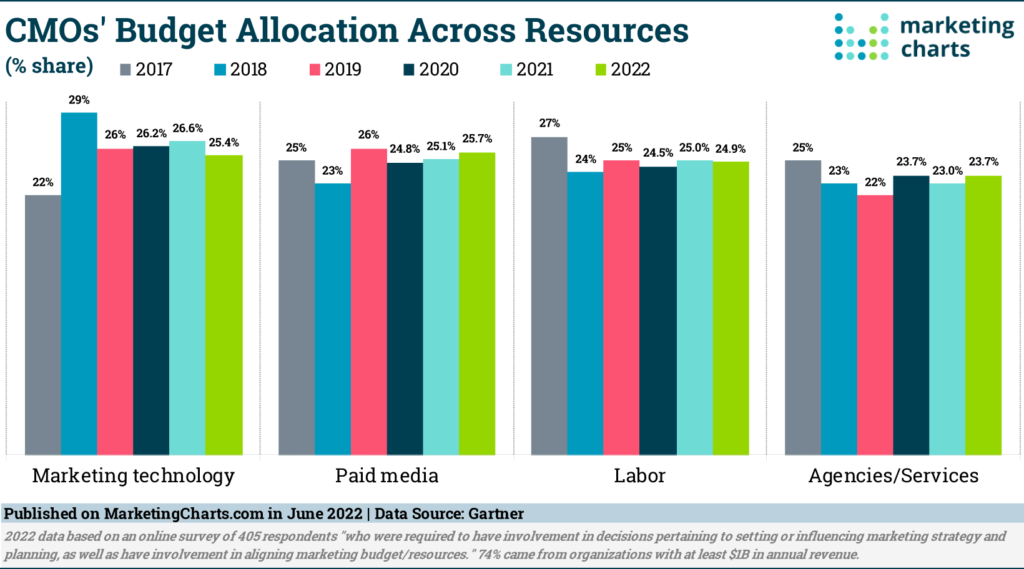

MarTech Slips to 1 in 4 Resource Dollars

The marketing resource budget mix is largely unchanged, though there is a little variance from last year. This year’s survey indicates that marketing technology (“martech”) accounts for 25.4% share of resource budgets, down from 26.6% last year. As such, CMOs in this latest edition are spending slightly more on paid media (25.7% share, up from 25.1% share last year) than on martech.

Meanwhile, labor accounts for about one-quarter of resource dollars (24.9%, flat from 25% last year) and agencies and services 23.7% share, up slightly from 23% last year.

It’s interesting to see that spending on labor and agencies and services have remained generally flat, as marketers are reporting changes organizationally. Some 54% say that their function is growing in scope, while 58% say that their teams lack the capabilities required to deliver their strategy. This would suggest that labor budgets may rise as a share of the resource mix.

In terms of capability gaps, marketing data and analytics appears to be the hardest hit, with 26% of CMOs ranking this as a top-3 capability gap. Following that is customer understanding and experience management (23% in top-3) and martech (22% in top-3). The skills gap in marketing technology has been a longstanding issue preventing companies from reaching full martech marturity. As the number of tools available proliferates and marketers plan changes to their stacks, it will be quite an effort to stay on top of an evolving landscape.

Digital Commerce Less of a Priority

Whereas the pandemic put digital commerce at the forefront of marketing investments last year, that same prioritization is not as apparent this year. Last year digital commerce occupied a leading 12.5% of the marketing program and operational budget mix, but this year has fallen to fifth on the list (9.4% share). Gartner attributes this to environment in which “post-lockdown buying journeys adjust and the need for fast-track investment and capability building recedes.”

As such, this year the top marketing program and operational area in terms of budget share is campaign creation and management (10.1%). It’s followed closely by brand strategy and activism (9.7%), marketing operations (9.6%) and demand generation/sales enablement (9.5%).

Of note, marketing data and analytics, the top operational area in 2019, is now 4th from the bottom, at 9% share of these budgets.

For more on budgets, download the study here.

About the Data: The results are based on an online survey of 405 respondents “who were required to have involvement in decisions pertaining to setting or influencing marketing strategy and planning, as well as have involvement in aligning marketing budget/resources. Seventy-four percent of the respondents came from organizations with $1 billion or more in annual revenue.”

Source: https://www.marketingcharts.com/business-of-marketing/marketing-budgets-226083